碳交易手机客户端

新闻产生价值 资讯挖掘商机

号外!欧盟碳关税协商达成最终协议!2023年实施前最终细节落定

碳道小编 · 2022-12-14 09:12 · 阅读量 · 4712

摘要:欧盟委员会、欧盟理事会和欧洲议会在12月12日就欧盟碳关税(CBAM)进行了第四轮三方协商。13日凌晨,欧洲议会与理事会达成临时协议,同意建立欧盟碳边界调整机制,以应对气候变化和防止碳泄漏。至此,CBAM的部分重要细节已经敲定,但仍有几个问题——如过渡期、免费配额的退出时间表还没有确定。

原文:

On Tuesday morning, MEPs reached a provisional agreement with Council to set up an EU Carbon Border Adjustment Mechanism to combat climate change and prevent carbon leakage.

According to the deal reached, an EU Carbon Border Adjustment Mechanism (CBAM) will be set up to equalise the price of carbon paid for EU products operating under the EU Emissions Trading System (ETS) and the one for imported goods. This will be achieved by obliging companies that import into the EU to purchase so-called CBAM certificates to pay the difference between the carbon price paid in the country of production and the price of carbon allowances in the EU ETS.

The law will incentivise non-EU countries to increase their climate ambition. Only countries with the same climate ambition as the EU will be able to export to the EU without buying CBAM certificates. The new rules will therefore ensure that EU and global climate efforts are not undermined by production being relocated from the EU to countries with less ambitious policies.

The new bill will be the first of its kind. It is designed to be in full compliance with World Trade Organisation (WTO) rules. It will apply from 1 October 2023 but with a transition period where the obligations of the importer shall be limited to reporting. To avoid double protection of EU industries, the length of the transition period and the full phase in of the CBAM will be linked to the phasing out of the free allowances under the ETS. This will be negotiated later this week in connection with the revision of the ETS and the results integrated into the CBAM regulation.

The scope of CBAM

CBAM will cover iron and steel, cement, aluminium, fertilisers and electricity, as proposed by the Commission, and extended to hydrogen, indirect emissions under certain conditions, certain precursors as well as to some downstream products such as screws and bolts and similar articles of iron or steel.

Before the end of the transition periodthe Commission shall assess whether to extend the scope to other goods at risk of carbon leakage, including organic chemicals and polymers, with the goal to include all goods covered by the ETS by 2030. They shall also assess the methodology for indirect emissions and the possibility to include more downstream products.

The governance of CBAM will be now more centralised, with the Commission in charge of most of the tasks. By the end of 2027, the Commission will do a complete review of CBAM including an assessment of progress made in international negotiations on climate change, as well as the impact on imports from developing countries, in particular the least developed countries (LDCs).

Quote

After the deal, rapporteur Mohammed Chahim (S&D, NL), said: “CBAM will be a crucial pillar of European climate policies. It is one of the only mechanisms we have to incentivise our trading partners to decarbonise their manufacturing industry. On top of this, it is an alternative to our current carbon leakage measures, which will allow us to apply the polluter pays principle to our own industry. A win-win situation."

A press conference with the rapporteur and Pascal Canfin (Renew, FR), the Chair of the Committee on Environment and Public Health is scheduled for Tuesday morning at 09.30 CEST in Strasbourg. More information on how to follow here.

Next steps

This partial deal is dependent on an agreement on the reform of the EU Emissions Trading System. Parliament and Council will have to formally approve the agreement before the new law can come into force. The new law will come into force 20 days after its publication in the EU Official Journal.

Background

CBAM is part of the “Fit for 55 in 2030 package", which is the EU’s plan to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels in line with the European Climate Law.

原文链接:https://www.europarl.europa.eu/news/en/press-room/20221212IPR64509/deal-reached-on-new-carbon-leakage-instrument-to-raise-global-climate-ambition

CBAM三方协商现场(来源:欧洲议会)

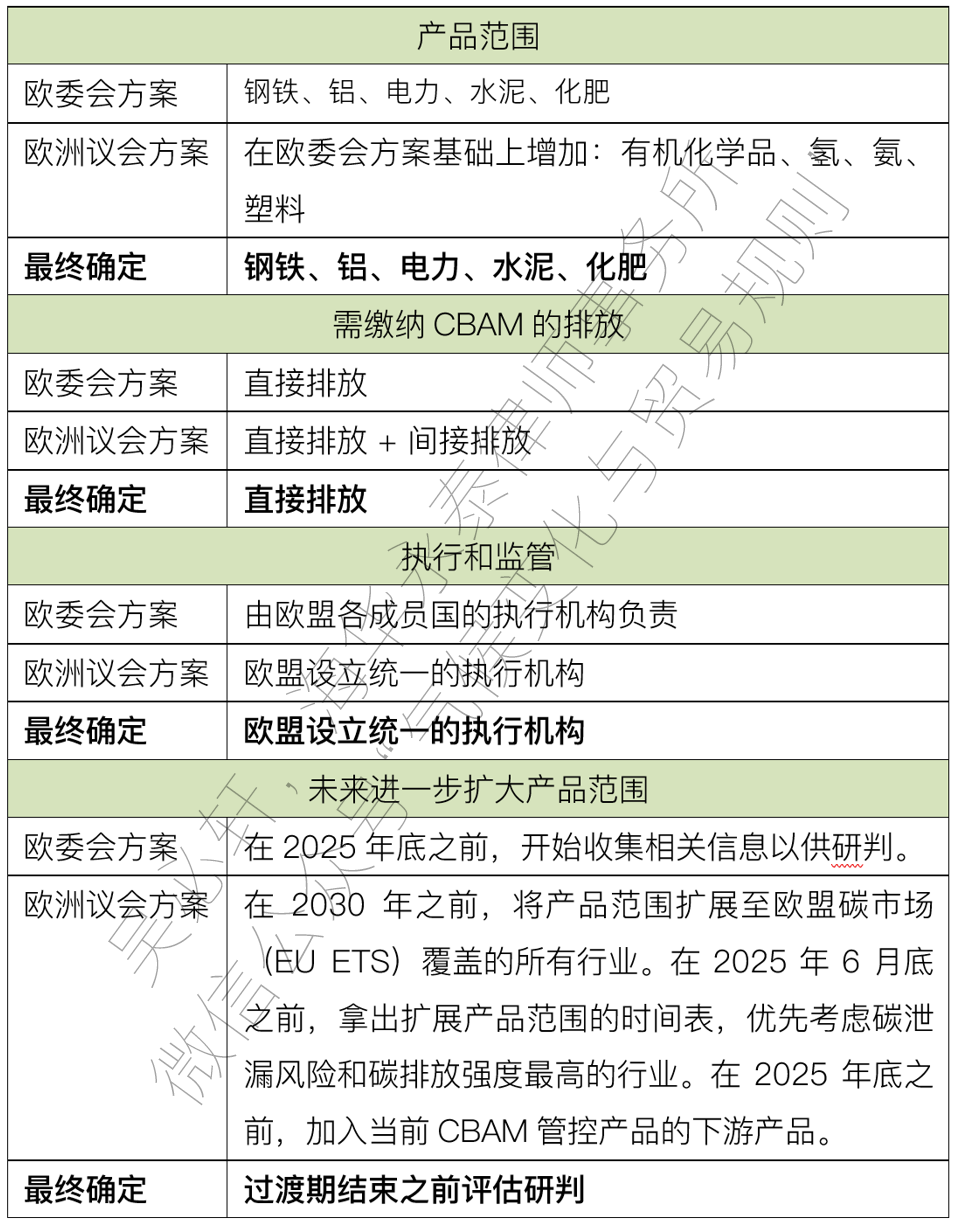

欧盟委员会、欧盟理事会和欧洲议会在12月12日就欧盟碳关税(CBAM)进行了第四轮三方协商。13日凌晨,欧洲议会与理事会达成临时协议,同意建立欧盟碳边界调整机制,以应对气候变化和防止碳泄漏。至此,CBAM的部分重要细节已经敲定,但仍有几个问题——如过渡期、免费配额的退出时间表还没有确定。产品范围:钢铁、水泥、铝、化肥和电力

排放范围:直接排放

笔者简要梳理一下最终达成的细节内容:

1、实施期限:CBAM规则从 2023年10月1日起适用,存在过渡期,但由于过渡期与EU-ETS(欧盟碳市场)免费配额退出时间表息息相关(避免双重保护原则),因此具体的时间将在EU-ETS改革方案与CBAM实施进行协商后确定。

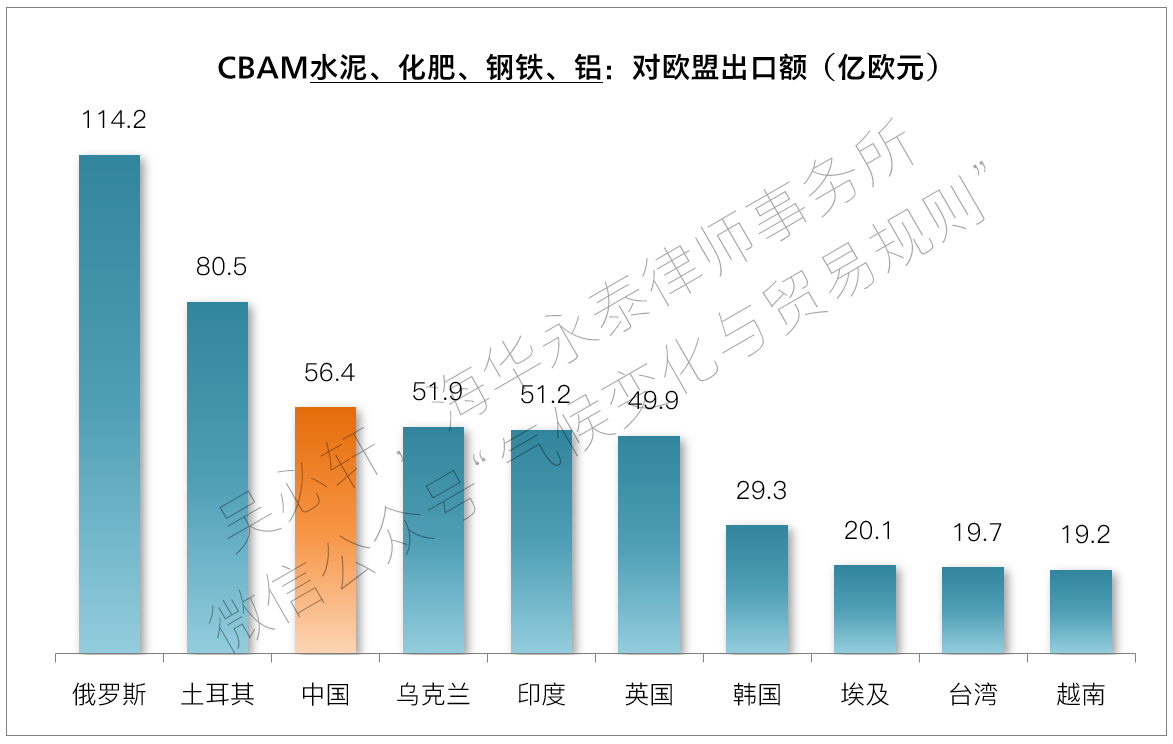

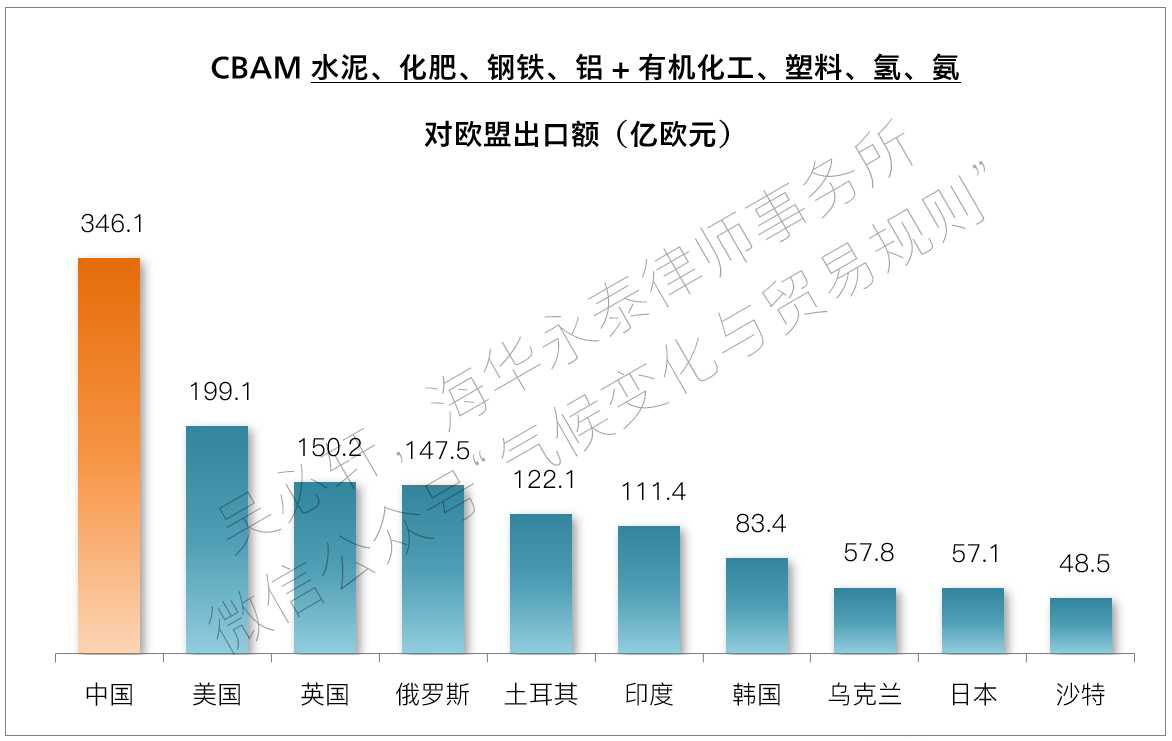

2、涵盖范围:CBAM将按照欧委会的提议涵盖钢铁、水泥、铝、化肥和电力,并扩展到氢气、特定条件下的间接排放、某些前体以及一些下游产品,例如螺钉和螺栓以及类似的物品铁或钢。

3、价格:与之前三方的文本内容保持不变,进口商购买CBAM证书价格与EU-ETS(欧盟碳市场)价格一致。具体数额方面,进口商将支付在生产国支付的碳价与欧盟碳市场的碳配额价格之间的差额。

4、豁免机制:为了激励非欧盟国家提高其气候雄心,仅对于欧盟具有相同气候目标的国家豁免CBAM。

5、扩大范围:在过渡期结束之前,欧委会应评估是否将范围扩大到其他有碳泄漏风险的商品,包括有机化学品和塑料等。CBAM的目标是到2030年涵盖所有EU-ETS所覆盖的商品,在此期间,欧委会还应评估间接排放和纳入更多下游产品的可能性。

最早到本周末我们才能看到CBAM的100%完整面貌。但是针对国内最关心的产品范围和排放范围问题,现在已经有了答案。笔者根据目前收集到的信息,概括如下:已有明确答案的问题:

简要回顾一下,2022年6月22日欧洲议会通过议会版的CBAM方案后,欧委会、欧理事会和欧议会三方已全部形成了各自的CBAM方案。为了达成最后的协议,三方已于7月11日、10月4日和11月8日已进行了三次讨论协商。由于欧盟整体工业面临的由地缘政治风波带来的不稳定性影响未能减轻,如期推进绿色低碳转型目标与解决欧盟面临的能源困局之间的平衡变得艰难。受此主要影响,各方关于协商内容存在一定的争议(特别是对EU-ETS改革方案的争议),导致三方协商的进度未及预期。

经历了长达半年的trialogue,CBAM实施方案最终落定,但从具体细节来看,却也存在诸多未决的“敞口”,也是当前欧盟甚至是全球能源转型遭遇众多不确定因素干扰的体现。继续等待12月16日EU-ETS改革方案的内容,并期待欧盟公布正式文本细节,再为读者进行深入的分析和解读。

文章来源::欧洲议会网站、吴必轩(海华永泰(北京)律师事务所高级合伙人、中国碳中和五十人论坛特邀研究员)、奇点能源郑颖、王康(中国碳中和五十人论坛特邀研究员)